A non-recourse loan agreement is a legal document that outlines the terms and conditions of a loan where the lender is only entitled to collect the loan amount and interest from the specific collateral pledged as security. The borrower is not personally liable for the loan, meaning their personal assets cannot be seized to satisfy the debt.

Key Components of a Non-Recourse Loan Agreement

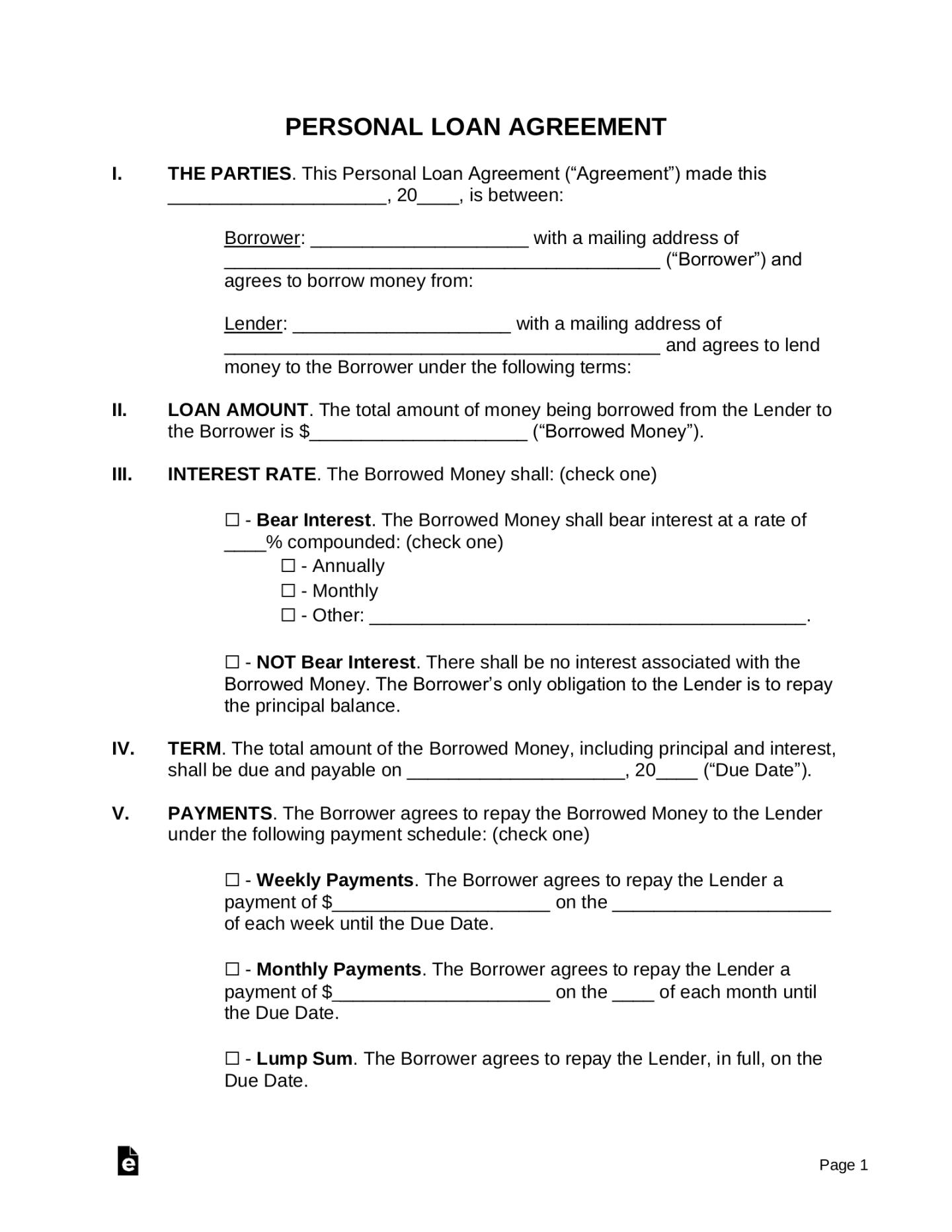

1. Parties: Clearly identify the lender and borrower, including their full legal names and addresses.

2. Loan Amount and Interest Rate: Specify the total loan amount, interest rate, and any applicable fees or charges.

3. Repayment Schedule: Outline the repayment terms, including the due date for principal and interest payments.

4. Collateral: Describe the specific collateral pledged as security for the loan, including its value and location.

5. Default: Define what constitutes a default event, such as missed payments or failure to maintain insurance on the collateral.

6. Remedies: Specify the remedies available to the lender in case of default, including the right to foreclose on the collateral and sell it to recover the loan amount.

7. Non-Recourse Provision: Clearly state that the loan is non-recourse, meaning the borrower is not personally liable for the debt.

8. Governing Law: Indicate the jurisdiction that governs the agreement, which determines the applicable laws and legal procedures.

9. Entire Agreement: Specify that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

10. Signatures: Ensure that both the lender and borrower sign the agreement, along with any required witnesses or notarization.

Design Elements for a Professional Non-Recourse Loan Agreement Template

1. Font: Choose a professional and legible font, such as Times New Roman, Arial, or Calibri.

2. Font Size: Use a font size that is easy to read, such as 12 points.

3. Line Spacing: Maintain consistent line spacing throughout the document to improve readability.

4. Margins: Use standard margins (1 inch on all sides) to create a balanced layout.

5. Headings and Subheadings: Use clear and concise headings and subheadings to organize the content and make it easier to navigate.

6. Numbering and Bullets: Use numbering and bullets to create lists and improve clarity.

7. White Space: Incorporate white space between sections to enhance readability and visual appeal.

8. Formatting: Use bold, italics, and underlining to emphasize key points or differentiate between sections.

9. Page Numbers: Include page numbers at the bottom of each page for easy reference.

10. Professional Letterhead: If applicable, use a professional letterhead with the lender’s name, address, and contact information.

Additional Considerations

Legal Counsel: Consult with an attorney to ensure that the non-recourse loan agreement is legally sound and protects your interests.

By following these guidelines and incorporating professional design elements, you can create a non-recourse loan agreement template that is both informative and visually appealing. This will help to establish trust and credibility with potential borrowers and ensure a smooth and efficient loan process.