Understanding Net Present Value (NPV)

Net Present Value (NPV) is a financial metric that calculates the present value of future cash flows, discounted at a specific rate. It is a valuable tool for businesses to assess the profitability of potential investments.

Designing the Template: Essential Elements

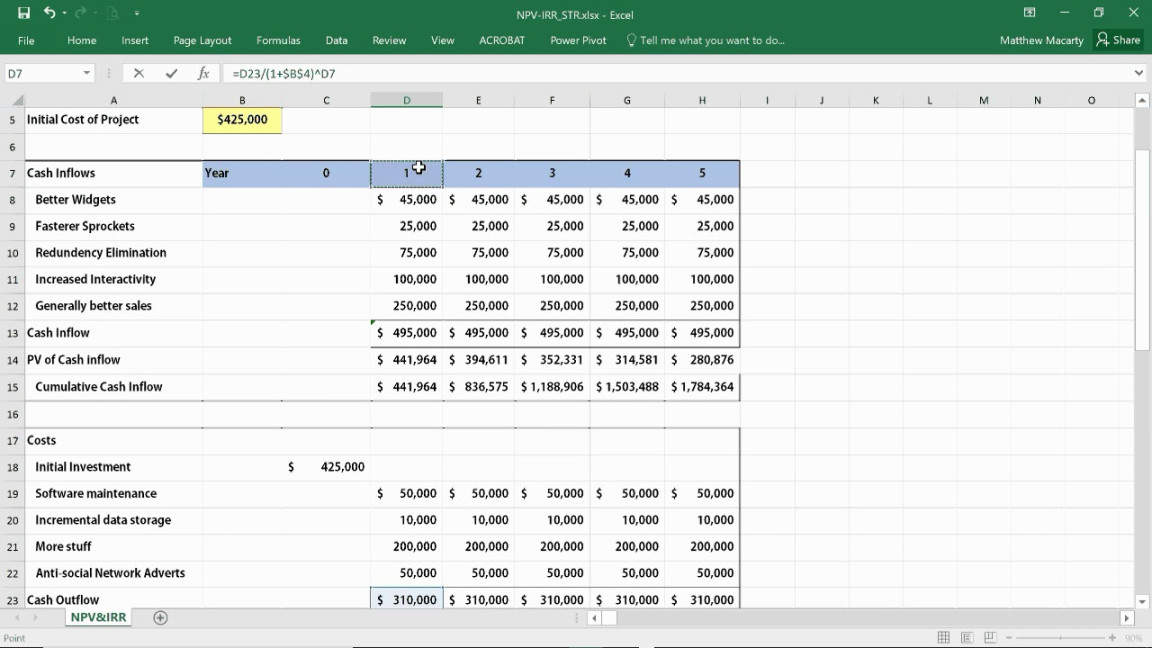

1. Clear and Concise Layout: A well-organized layout is crucial for a professional NPV Excel template. Use consistent formatting, such as font size, font style, and alignment, to enhance readability.

2. Meaningful Headers and Labels: Clearly label all input cells and output cells to avoid confusion. Use descriptive headers that accurately represent the data they contain.

3. Logical Data Entry: Organize the input cells in a logical sequence, making it easy for users to enter data. Consider using input validation to prevent errors.

4. Formula Calculation: Implement accurate NPV formulas in the designated cells. Ensure that the formulas are linked to the correct input cells to calculate the NPV correctly.

5. Formatting and Currency: Format the output cells to display the NPV in the appropriate currency format. Use conditional formatting to highlight positive or negative NPV values.

Enhancing Professionalism and Trustworthiness

1. Consistent Branding: Incorporate your company’s branding elements, such as logo, colors, and fonts, into the template. This helps establish a professional and recognizable identity.

2. Error Handling: Implement error handling mechanisms to prevent incorrect data entry. For example, you can use data validation to restrict input values to certain ranges or formats.

3. Comments and Instructions: Add comments or instructions within the template to guide users on how to use it effectively. This demonstrates your commitment to providing a user-friendly experience.

4. Accessibility: Ensure the template is accessible to users with disabilities by following accessibility guidelines. This includes using appropriate color contrasts, providing alternative text for images, and using keyboard navigation.

5. Documentation: Provide comprehensive documentation that explains the purpose of the template, how to use it, and how to interpret the results. This builds trust and credibility.

Advanced Features for Enhanced Functionality

1. Sensitivity Analysis: Incorporate sensitivity analysis tools to assess how changes in input variables affect the NPV. This can help users understand the risks and uncertainties associated with the investment.

2. Scenario Planning: Create multiple scenarios to explore different potential outcomes. This allows users to evaluate the impact of various assumptions on the NPV.

3. Data Visualization: Use charts and graphs to visually represent the NPV and other relevant data. This can make the results easier to understand and communicate.

4. Automation: Automate repetitive tasks, such as data entry or formula calculations, to improve efficiency and reduce errors.

5. Integration with Other Systems: Consider integrating the template with other financial systems, such as accounting software or project management tools, to streamline workflows.

Conclusion

By following these guidelines, you can create a professional Net Present Value Excel template that is both visually appealing and functionally robust. A well-designed template can help businesses make informed investment decisions and enhance their financial performance.