A minority shareholder agreement is a legal document that outlines the rights, obligations, and protections of a minority shareholder in a company. It is essential for any company with multiple shareholders, especially when one shareholder holds a controlling interest. This agreement helps to prevent conflicts and disputes between majority and minority shareholders, ensuring a harmonious and productive business environment.

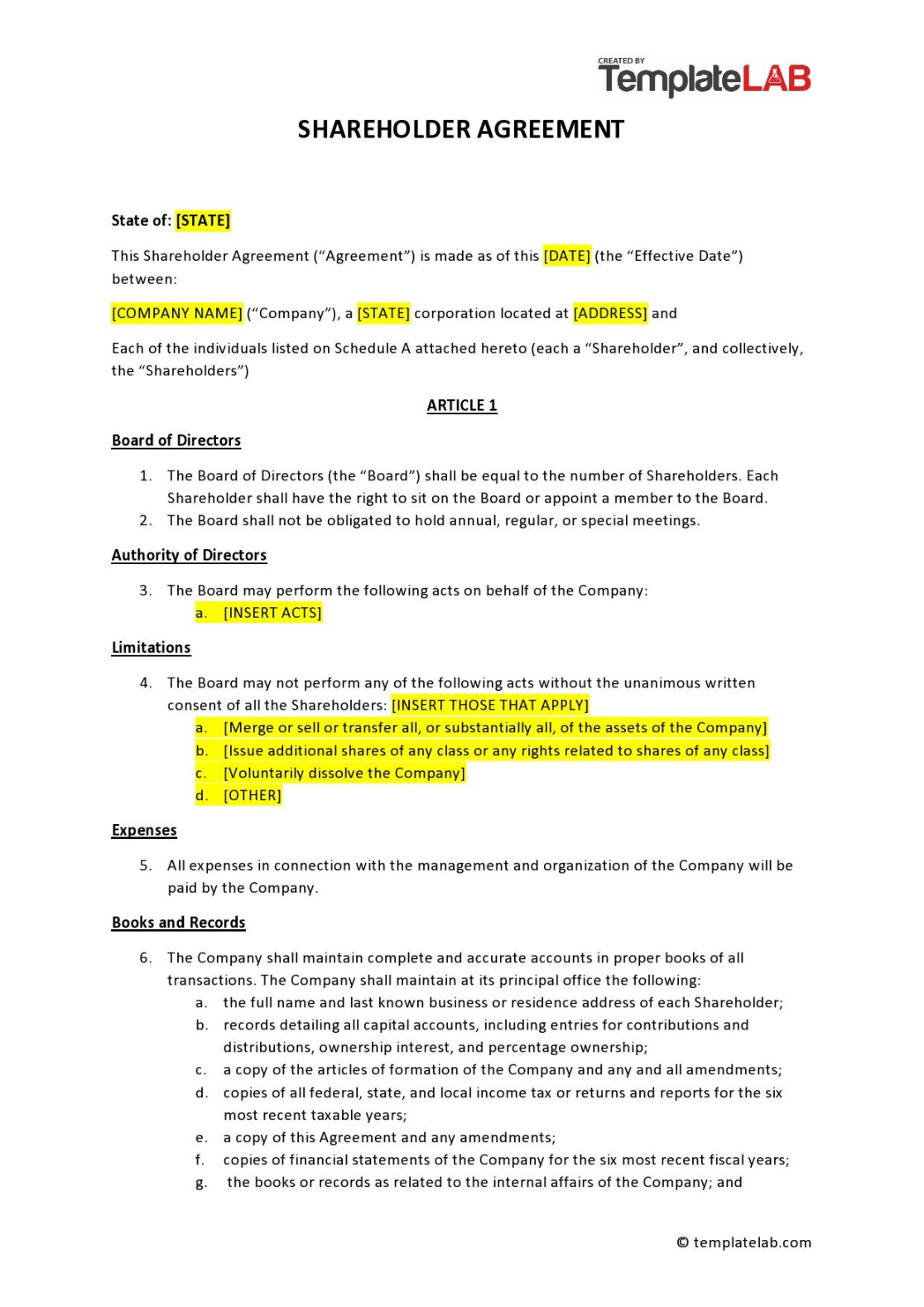

Key Components of a Minority Shareholder Agreement

A well-crafted minority shareholder agreement should include the following key components:

1. Identification of Parties

Clearly state the names and addresses of all parties involved in the agreement.

2. Definitions

Define key terms and phrases that may be unfamiliar to the parties, such as “controlling interest,” “dilution,” and “tag-along rights.”

3. Voting Rights

Outline the voting rights of the minority shareholder, including their ability to vote on major corporate decisions.

4. Information Rights

Specify the minority shareholder’s right to receive financial and operational information about the company.

5. Anti-Dilution Protection

Protect the minority shareholder’s ownership interest in the event of future issuances of equity securities.

6. Transfer Restrictions

Limit the ability of the minority shareholder to transfer their shares to third parties.

7. Right of First Refusal

Grant the minority shareholder the right to purchase any shares that a majority shareholder intends to sell.

8. Tag-Along Rights

Allow the minority shareholder to participate in any sale of the company.

9. Drag-Along Rights

10. Dispute Resolution

Specify the mechanism for resolving disputes between the parties.

11. Governing Law and Jurisdiction

Indicate the governing law that will apply to the agreement.

Design Elements for Professionalism and Trust

To create a minority shareholder agreement that conveys professionalism and trust, consider the following design elements:

Use high-quality paper and printing.

By incorporating these key components and design elements, you can create a minority shareholder agreement that effectively protects the rights of both majority and minority shareholders, fostering a harmonious and successful business relationship.