A private loan agreement template is a crucial document for individuals or businesses involved in lending or borrowing money. It outlines the terms and conditions of the loan, ensuring a clear understanding between both parties. This guide will provide you with the necessary steps to create a professional and legally sound private loan agreement template using WordPress.

Essential Elements of a Private Loan Agreement Template

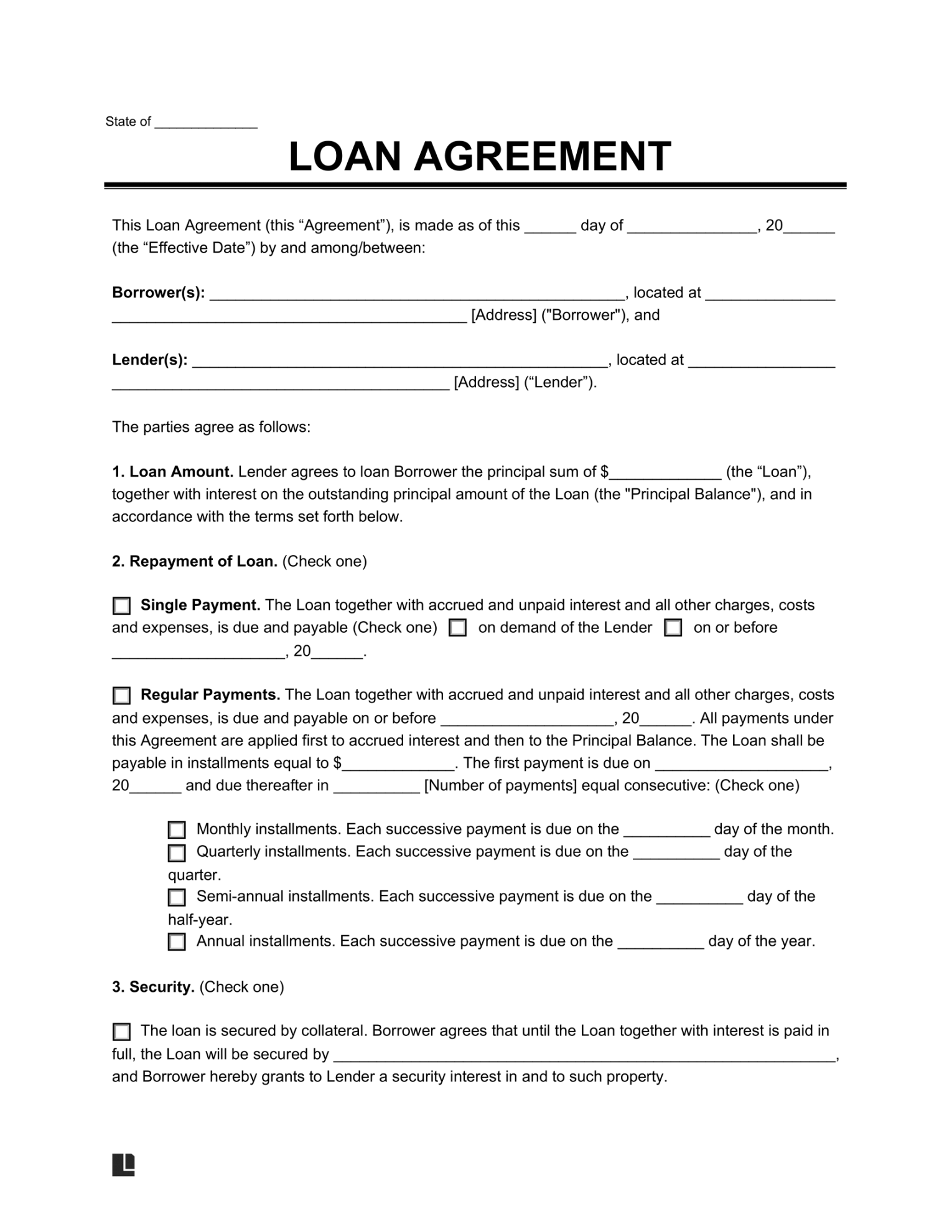

1. Loan Amount and Terms: Clearly specify the total loan amount, interest rate, repayment schedule (e.g., monthly, quarterly, annually), and the loan maturity date.

2. Interest Rate: Define the interest rate calculation method (e.g., simple or compound interest) and whether it’s fixed or variable.

3. Repayment Schedule: Outline the specific dates and amounts for each loan payment.

4. Default and Late Payment Provisions: Specify the consequences of missed or late payments, including late fees, acceleration of the loan balance, and potential legal actions.

5. Security Interest (if applicable): If the loan is secured by collateral, describe the specific assets being used as collateral and the procedures for enforcing the security interest.

6. Prepayment Clause: Determine whether the borrower can prepay the loan early and, if so, whether any prepayment penalties apply.

7. Governing Law: Indicate the jurisdiction that will govern the terms of the agreement.

8. Dispute Resolution: Specify the method for resolving disputes, such as mediation, arbitration, or litigation.

9. Entire Agreement Clause: State that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

10. Notices: Outline how notices will be served between the parties, including addresses and methods of delivery.

Design Considerations for a Professional Template

1. Clean and Consistent Layout: Use a clean and uncluttered layout with consistent fonts, spacing, and margins.

2. Professional Typography: Choose fonts that are easy to read and convey a professional image. Avoid overly decorative or difficult-to-read fonts.

3. Clear and Concise Language: Use clear and concise language that is easy to understand. Avoid legal jargon that may confuse the parties.

4. Headings and Subheadings: Use headings and subheadings to organize the content and make it easier to navigate.

5. White Space: Use white space effectively to create a visually appealing and readable document.

6. Branding (Optional): If you’re creating templates for a business, consider incorporating your company’s branding elements, such as logos or color schemes.

WordPress Tools for Creating Templates

1. Page Builders: Use page builders like Elementor, Divi, or Beaver Builder to create custom templates without coding.

2. Themes: Choose a theme that offers a clean and professional layout and customization options.

3. Plugins: Utilize plugins like PDF Export or Print Friendly to create printable versions of your templates.

Additional Tips for Creating a Professional Template

1. Consult with a Legal Professional: While this guide provides general information, it’s essential to consult with a legal professional to ensure your template complies with applicable laws and regulations.

2. Proofread Carefully: Thoroughly proofread your template to eliminate errors and ensure accuracy.

3. Test the Template: Test your template with different screen sizes and devices to ensure it displays correctly.

4. Provide Instructions: If you’re sharing your template with others, provide clear instructions on how to use it and customize it.

By following these guidelines and utilizing the available tools, you can create a professional and effective private loan agreement template that meets your specific needs and protects the interests of all parties involved.