A business loan agreement is a legally binding document that outlines the terms and conditions of a loan between a lender and a borrower. It serves as a formal contract that protects the interests of both parties involved. When creating a business loan agreement template, it is crucial to adhere to specific design elements that convey professionalism and trust.

Key Elements of a Business Loan Agreement Template

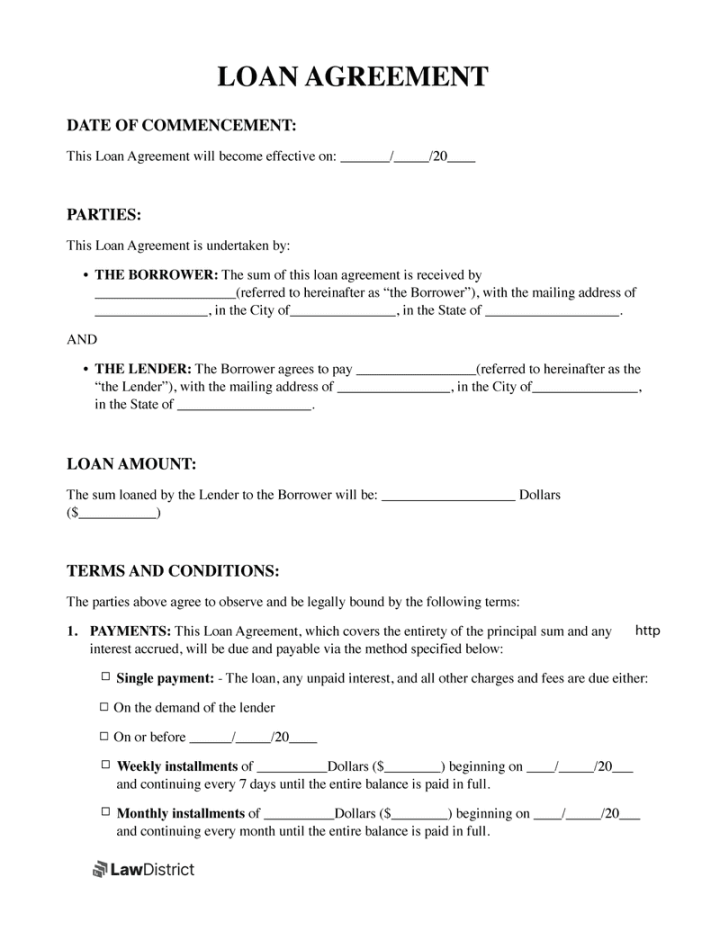

1. Parties Involved: Clearly identify the lender and the borrower. Include their full legal names, addresses, and contact information.

2. Loan Amount and Terms: Specify the total amount of the loan, the interest rate, and the repayment schedule.

3. Repayment Schedule: Outline the frequency and due dates of loan payments. Consider using a table format for clarity.

4. Collateral: If applicable, describe the collateral that secures the loan. Provide a detailed description of the collateral, including its value and location.

5. Default: Define what constitutes a default on the loan. This may include missed payments, failure to meet other obligations, or bankruptcy.

6. Late Fees and Penalties: Specify the late fees and penalties that will be charged in case of missed payments.

7. Prepayment Clause: Indicate whether the borrower can prepay the loan and if there are any prepayment penalties.

8. Governing Law: Specify the jurisdiction that governs the loan agreement.

9. Dispute Resolution: Outline the procedure for resolving disputes between the lender and the borrower. This may include mediation or arbitration.

10. Entire Agreement: State that the loan agreement constitutes the entire agreement between the parties and supersedes any prior or contemporaneous communications.

11. Signatures: Ensure that both the lender and the borrower sign the agreement. Include a space for witnesses and notarization if required.

Design Considerations for a Professional Business Loan Agreement Template

1. Font: Choose a professional and legible font such as Times New Roman, Arial, or Calibri. Use a font size of 12 points for the main body text and a slightly larger font size for headings.

2. Layout: Use a clean and organized layout with consistent margins and spacing. Consider using a table of contents to help readers navigate the document.

3. Headings and Subheadings: Use headings and subheadings to divide the document into sections and subsections. Use a hierarchy of headings to indicate the relative importance of each section.

4. Numbering and Bullets: Use numbering and bullets to create lists and outlines. This can help improve readability and organization.

5. White Space: Use white space effectively to create a visually appealing and easy-to-read document. Avoid overcrowding the page with text.

6. Branding: If applicable, incorporate your company’s branding elements into the template. This can help create a professional and consistent look.

Additional Tips for Creating a Professional Business Loan Agreement Template

Use clear and concise language. Avoid legal jargon that may be difficult for the borrower to understand.

By following these guidelines, you can create a professional and effective business loan agreement template that protects the interests of both the lender and the borrower.