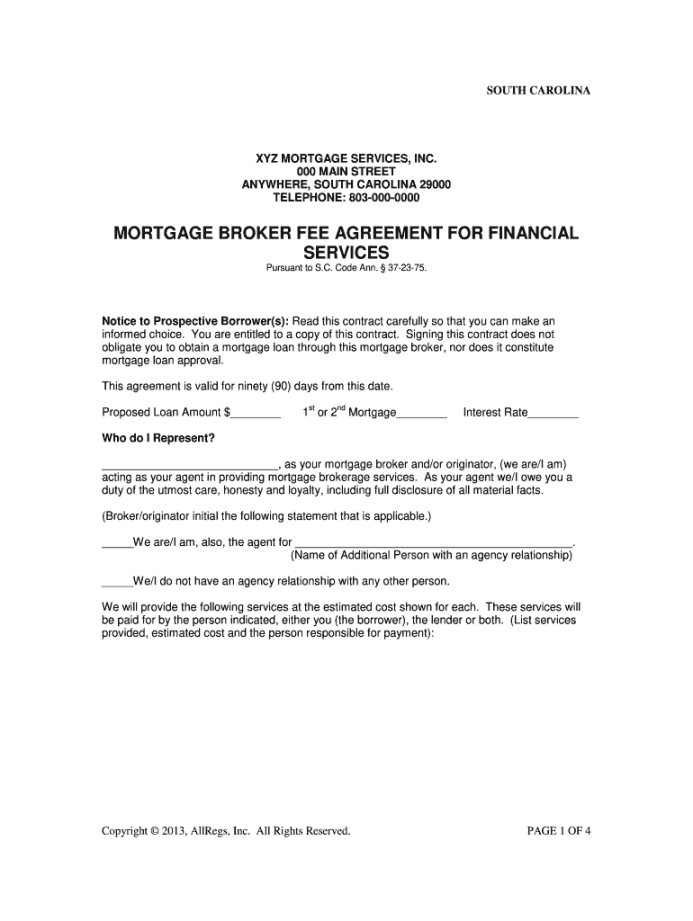

A commercial mortgage broker fee agreement template is a legal document that outlines the terms and conditions under which a commercial mortgage broker will receive compensation for their services. This document is crucial in establishing a clear and transparent relationship between the broker and the client.

Key Components of a Commercial Mortgage Broker Fee Agreement Template

1. Parties Involved: Clearly identify the parties involved in the agreement, including the name of the commercial mortgage broker, the borrower, and any other relevant entities.

2. Scope of Services: Define the specific services that the broker will provide, such as sourcing lenders, negotiating terms, and assisting with the loan application process.

3. Compensation Structure: Specify the method by which the broker will be compensated. This may include a flat fee, a percentage of the loan amount, or a combination of both.

4. Fee Schedule: Outline the specific fees that the borrower will be responsible for paying, including any upfront fees, closing costs, or ongoing charges.

5. Reimbursement of Expenses: Indicate whether the borrower will be responsible for reimbursing the broker for any out-of-pocket expenses incurred during the loan process.

6. Term and Termination: Specify the duration of the agreement and the conditions under which either party may terminate the relationship.

7. Confidentiality: Address the confidentiality obligations of both parties, ensuring that sensitive information is protected.

8. Governing Law: Specify the governing law that will apply to the agreement in case of a dispute.

9. Entire Agreement: Include a clause stating that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

10. Signatures: Ensure that both parties sign the agreement to indicate their acceptance of the terms and conditions.

Design Elements for a Professional Commercial Mortgage Broker Fee Agreement Template

To create a professional and trustworthy template, consider the following design elements:

Layout: Use a clean and uncluttered layout that is easy to read and navigate.

Additional Considerations

Customization: Tailor the template to your specific needs and the requirements of your jurisdiction.

By following these guidelines, you can create a professional and effective commercial mortgage broker fee agreement template that will help you build trust with your clients and protect your interests.