A Blank Loan Agreement Template is a foundational document that outlines the terms and conditions of a loan transaction between two parties. It serves as a legal contract that protects the interests of both the lender and the borrower. To create a professional template that conveys trust and professionalism, it is essential to adhere to specific design elements and formatting guidelines.

Essential Elements of a Blank Loan Agreement Template

A well-structured Blank Loan Agreement Template should include the following essential elements:

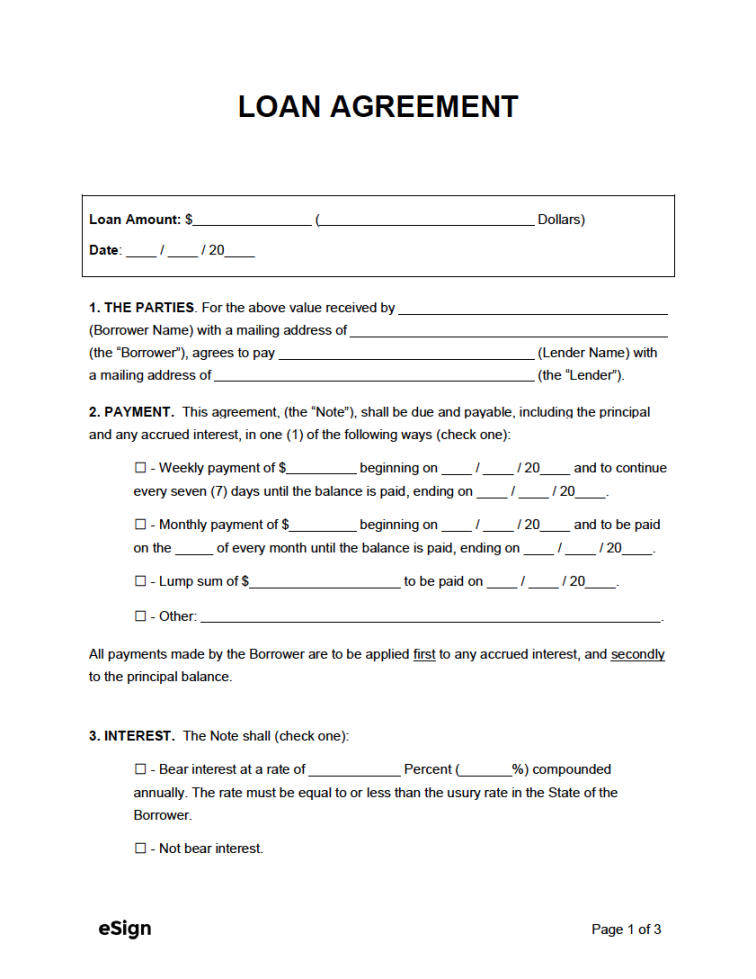

1. Identification of Parties: Clearly state the full names and addresses of both the lender and the borrower. This information should be placed prominently at the beginning of the template.

2. Loan Amount and Terms: Specify the total amount of the loan, the interest rate, and the repayment schedule. Include details on how interest will be calculated and whether there are any penalties for late payments.

3. Collateral (if applicable): If the loan is secured by collateral, clearly describe the nature and value of the collateral. Outline the procedures for repossession or foreclosure in case of default.

4. Repayment Schedule: Provide a detailed repayment schedule, including the due dates for principal and interest payments. Indicate whether there are any prepayment options or penalties.

5. Default Provisions: Define what constitutes a default and outline the consequences of default. This may include late payments, non-payment, or breach of other terms.

6. Governing Law and Jurisdiction: Specify the governing law that will apply to the loan agreement and the jurisdiction in which any disputes will be resolved.

7. Entire Agreement Clause: Include a clause stating that the loan agreement constitutes the entire agreement between the parties and supersedes any prior or contemporaneous communications or agreements.

8. Severability Clause: This clause ensures that if any provision of the loan agreement is found to be invalid or unenforceable, the remaining provisions will remain in full force and effect.

9. Waiver and Modification Clause: Indicate that any waiver or modification of the loan agreement must be made in writing and signed by both parties.

10. Dispute Resolution: Specify the method for resolving disputes, such as mediation, arbitration, or litigation.

Design Considerations for Professionalism and Trust

To create a Blank Loan Agreement Template that conveys professionalism and trust, consider the following design elements:

1. Font and Font Size: Choose a legible font that is easy to read, such as Times New Roman or Arial. Use a font size that is consistent throughout the template.

2. Spacing and Margins: Ensure that there is adequate spacing between lines and paragraphs to improve readability. Use consistent margins on all sides of the page.

3. Headings and Subheadings: Use clear and concise headings and subheadings to organize the content and make it easier to navigate.

4. Numbering and Bullet Points: Use numbering and bullet points to list items and create a more visually appealing presentation.

5. Alignment: Align the text consistently throughout the template, either left-aligned, right-aligned, or centered.

6. White Space: Use white space effectively to create a clean and uncluttered appearance.

7. Branding: If applicable, incorporate your company’s branding elements, such as your logo and color scheme.

Conclusion

A well-designed Blank Loan Agreement Template is essential for establishing a clear and legally binding agreement between a lender and a borrower. By following the guidelines outlined above, you can create a professional template that conveys trust and professionalism.